Source: ivylawsons.pages.dev

Source: ivylawsons.pages.dev

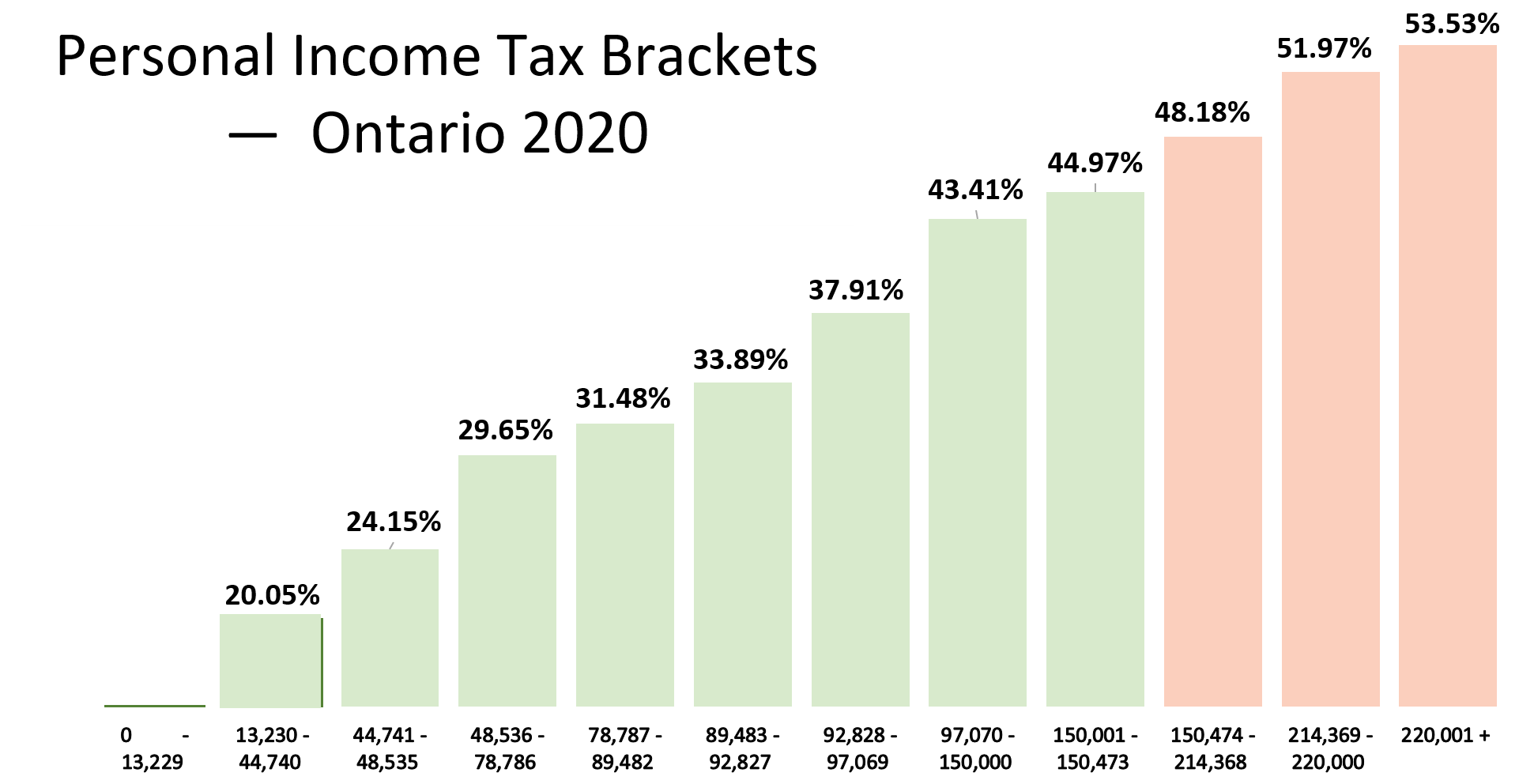

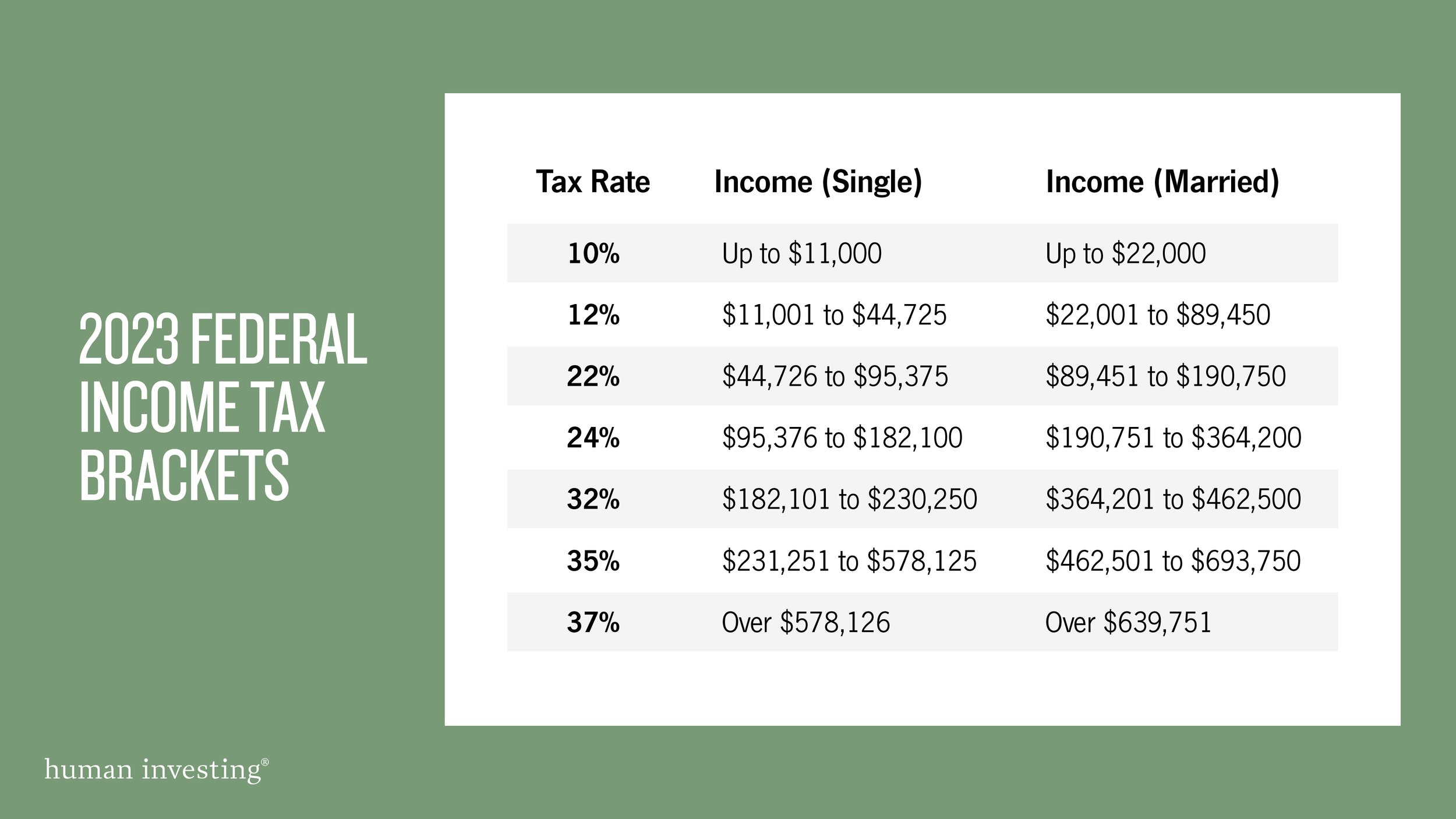

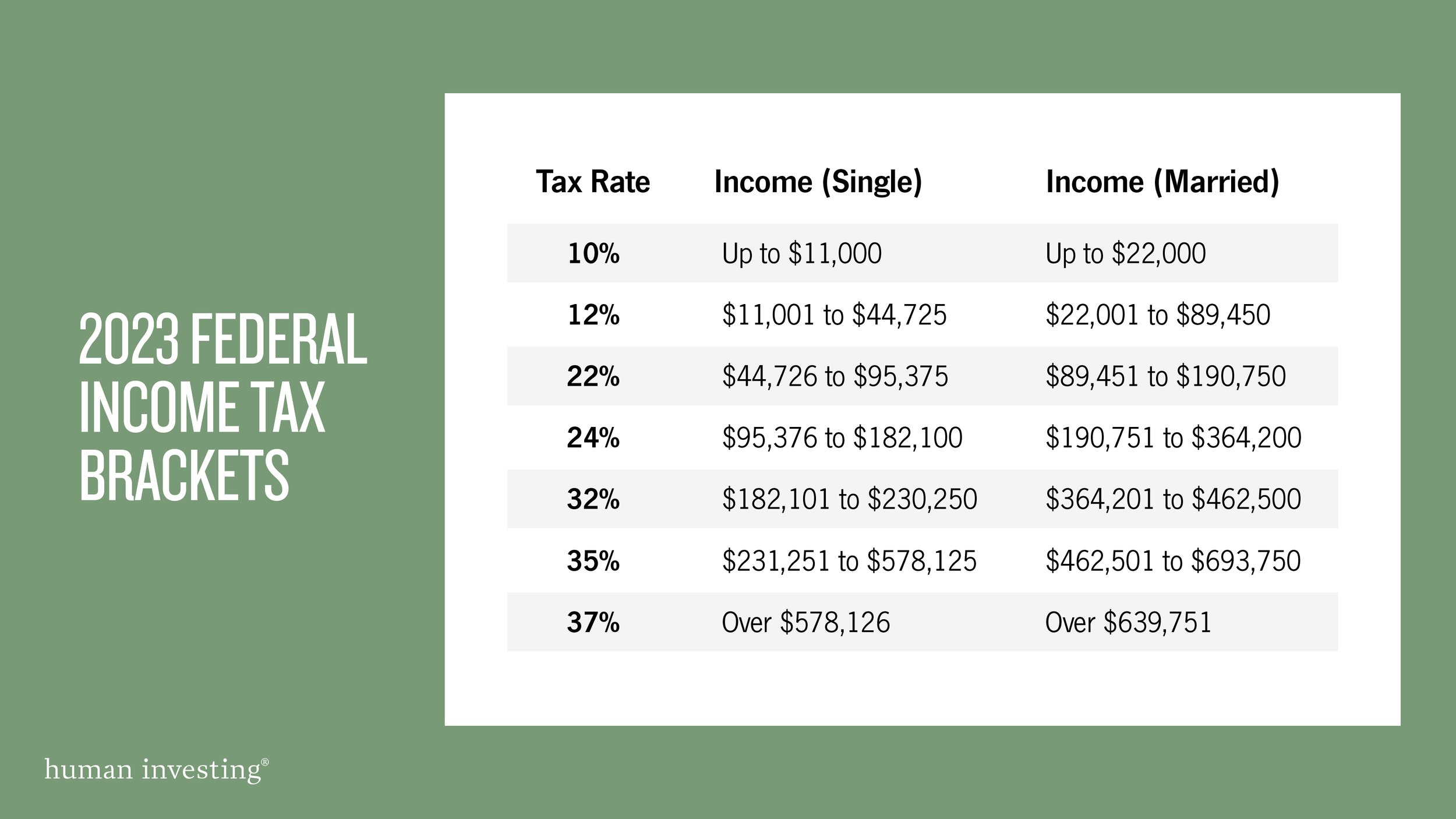

Canada 2025 And 2025 Tax Rates & Tax Brackets Images References Ivy The 2025 tax figures represent rates as of february 2025. Review ontario's 2025 federal and provincial personal income tax rates and determine your tax bracket and marginal tax rate.

Source: masonsinclairb.pages.dev

Source: masonsinclairb.pages.dev

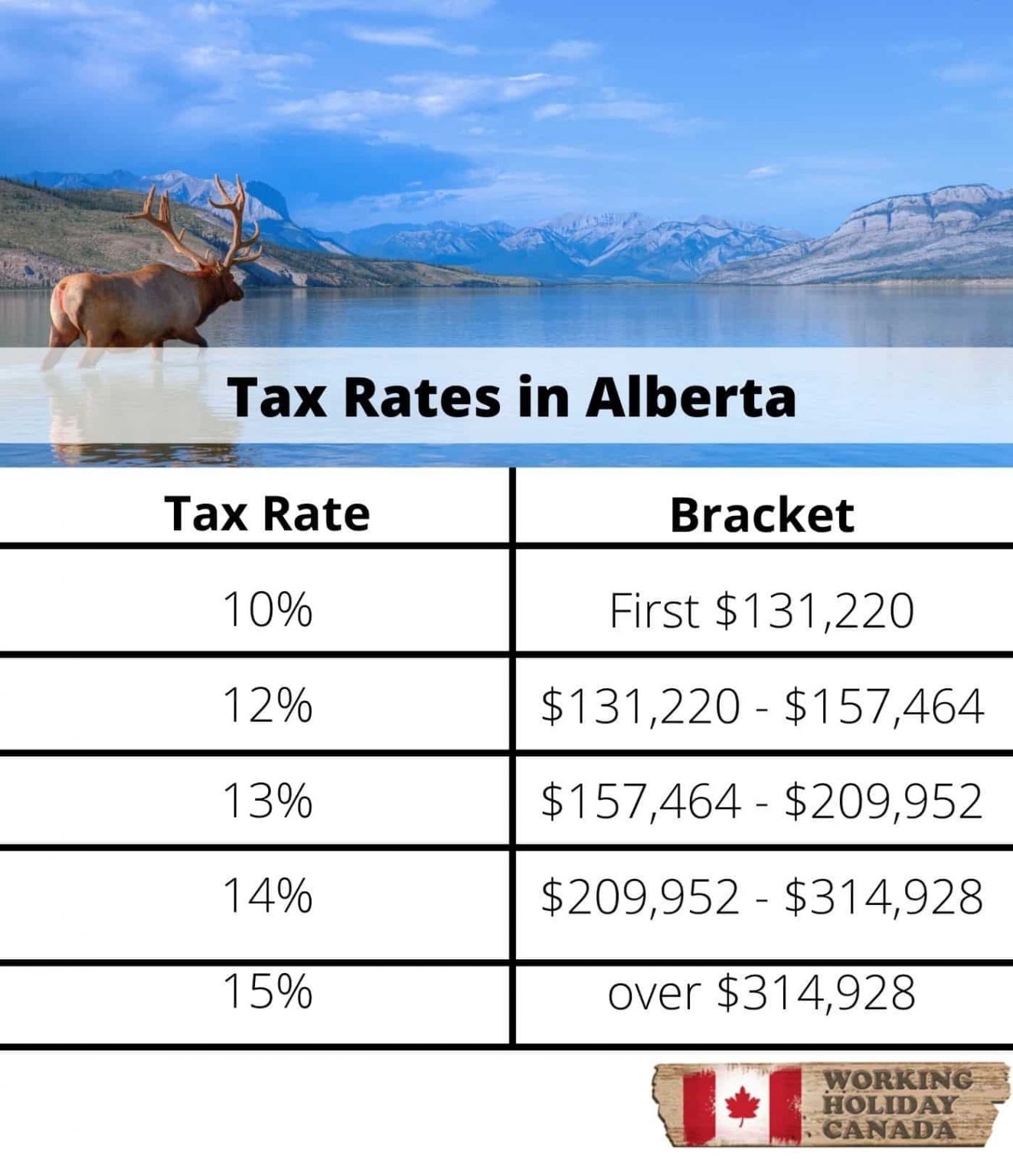

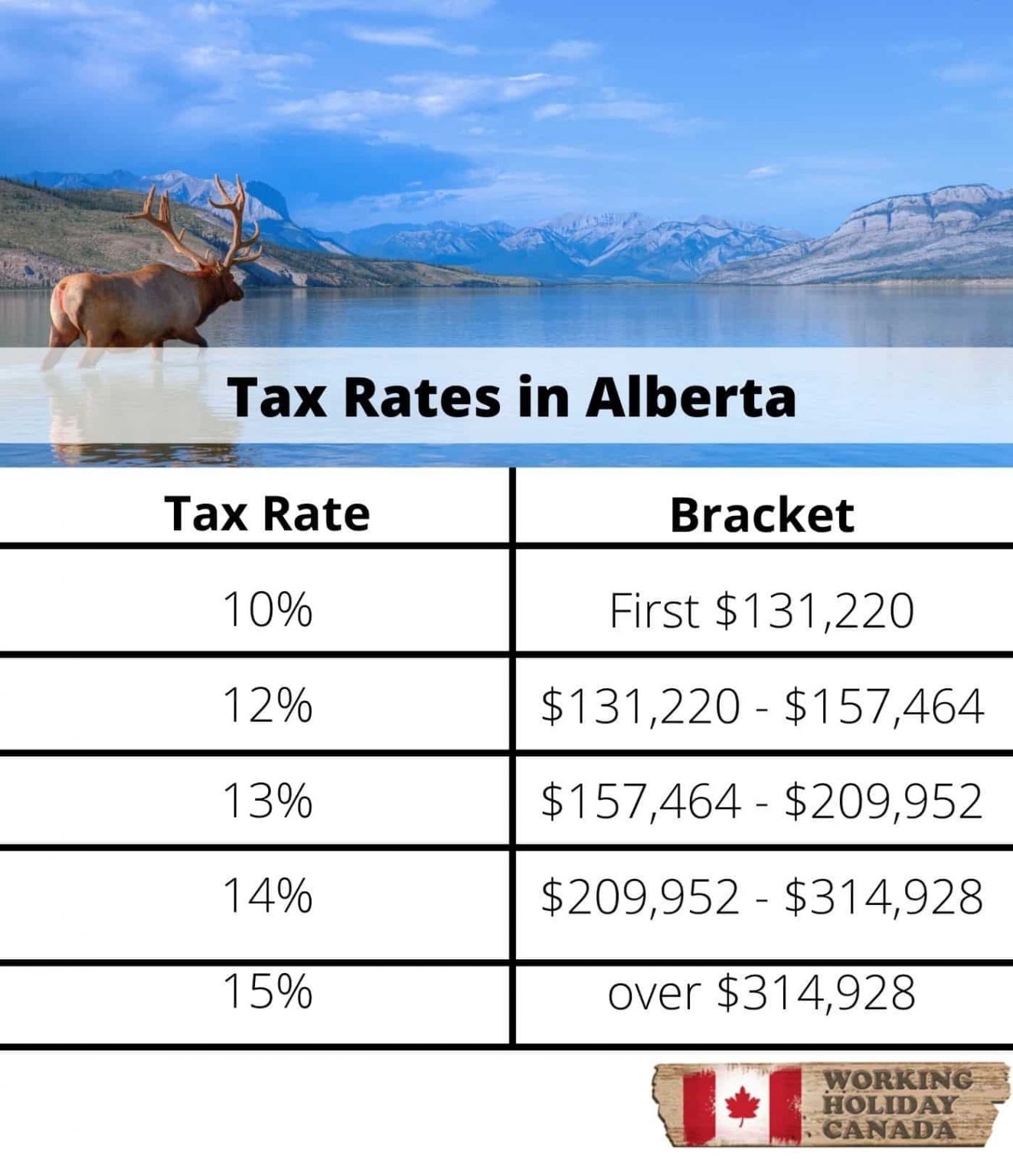

Marginal Tax Rates 2025 Alberta Mason B. Sinclair Review ontario's 2025 federal and provincial personal income tax rates and determine your tax bracket and marginal tax rate. The 2025 tax figures represent rates as of february 2025.

Source: linhjkgabriellia.pages.dev

Source: linhjkgabriellia.pages.dev

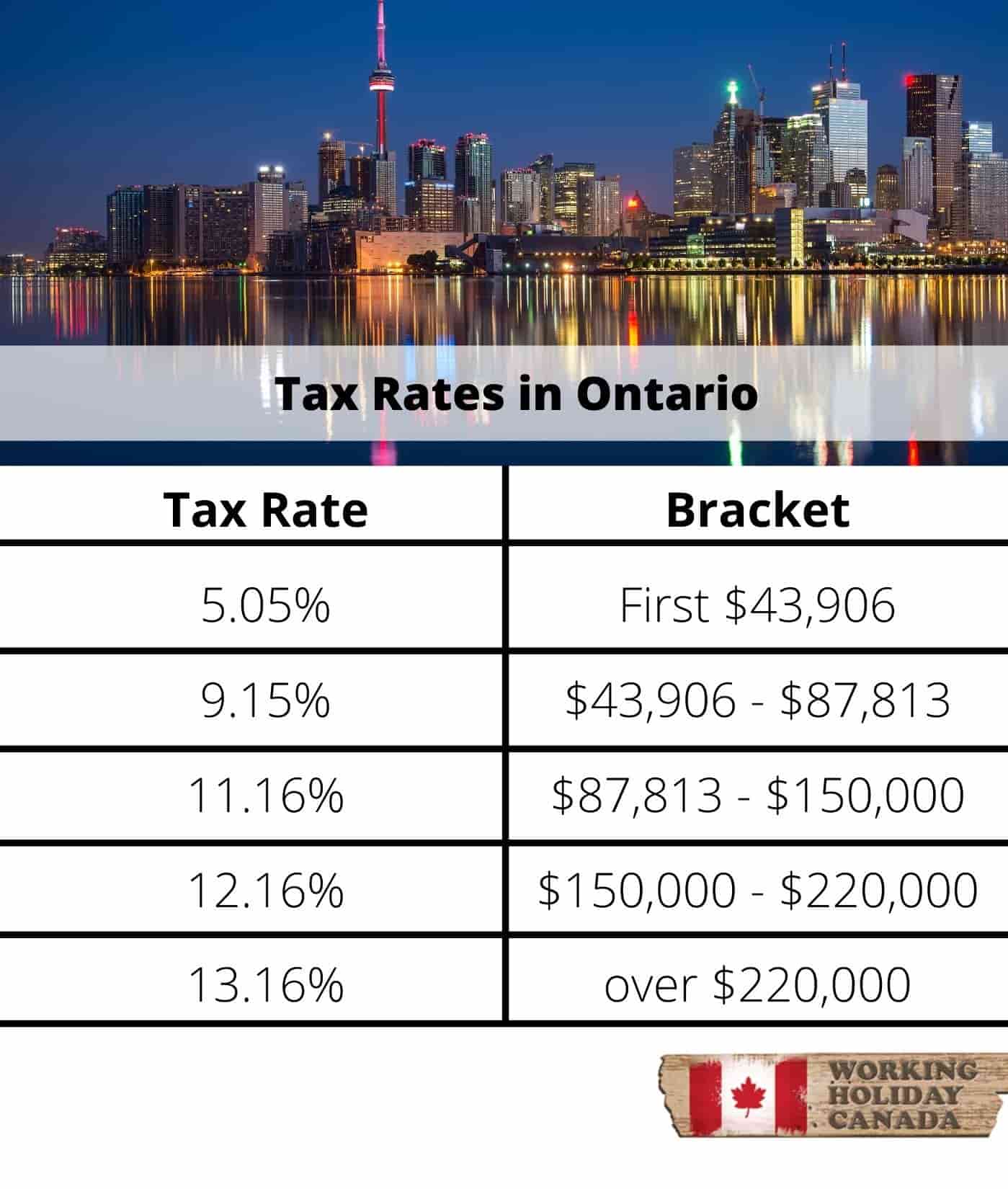

2025 Tax Brackets Ontario Canada Jonie Sephira Review ontario's 2025 federal and provincial personal income tax rates and determine your tax bracket and marginal tax rate. It is changed based on changes in the.

Source: karolvkerianne.pages.dev

Source: karolvkerianne.pages.dev

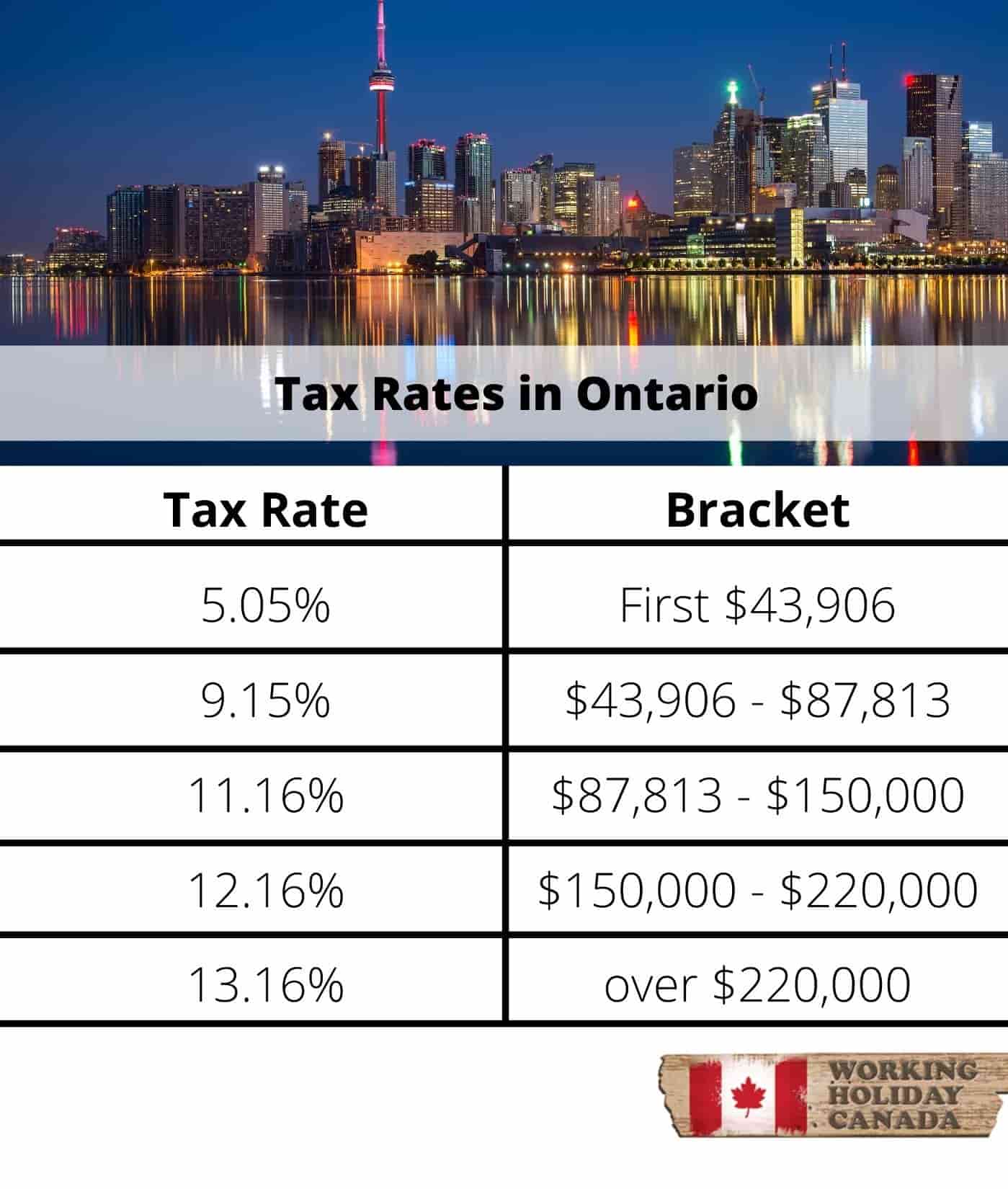

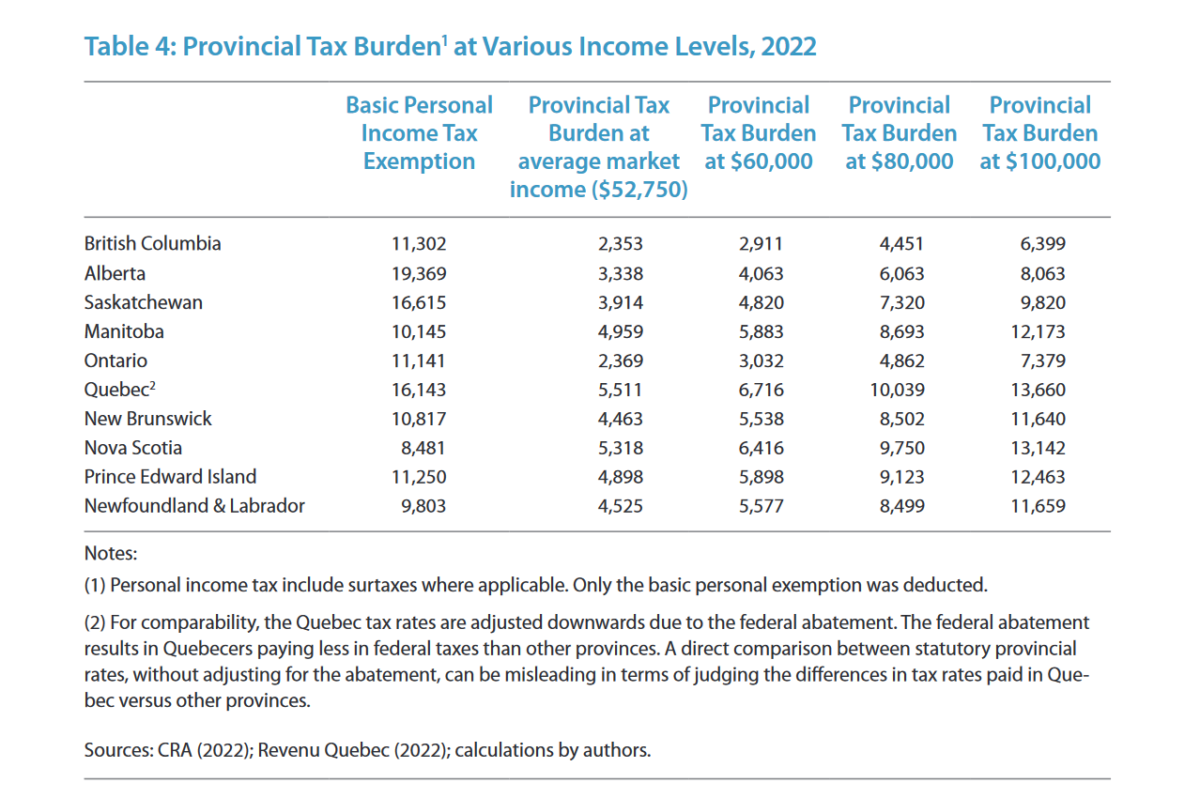

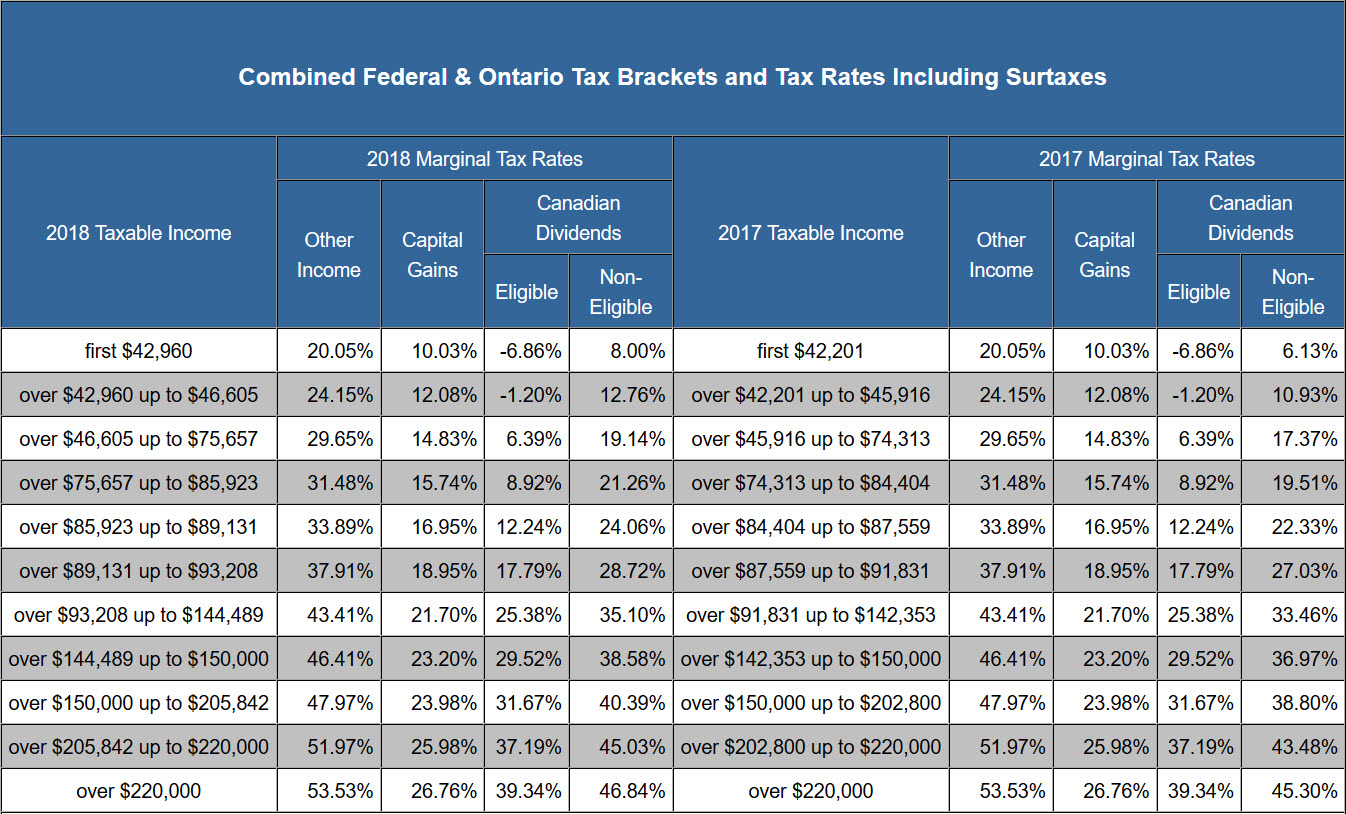

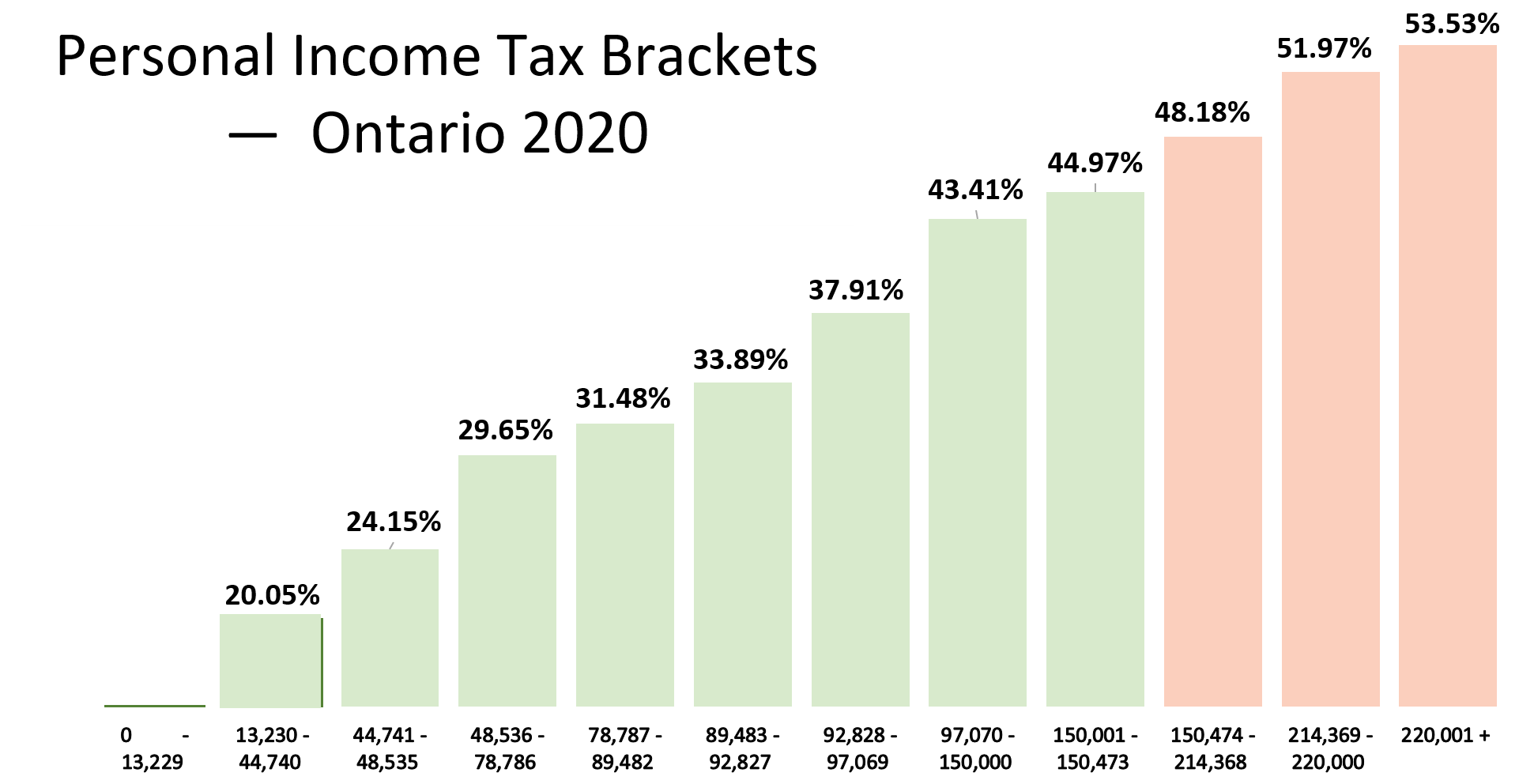

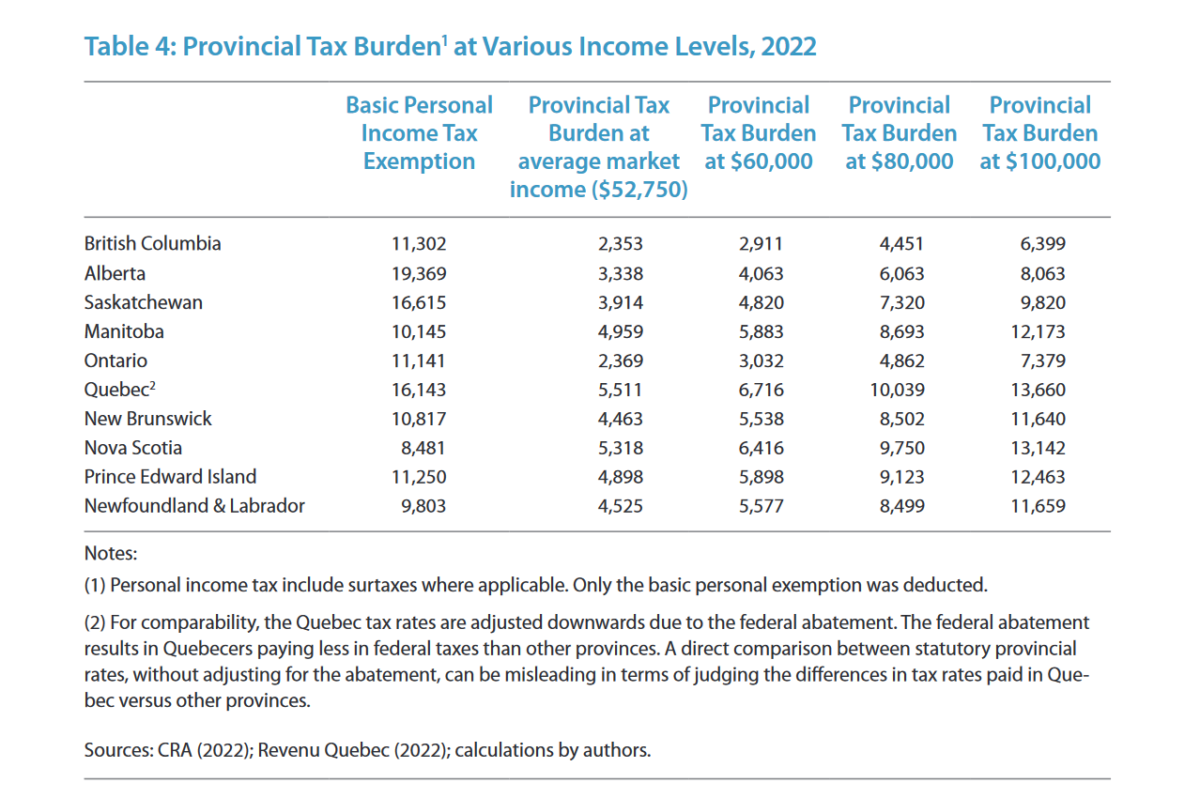

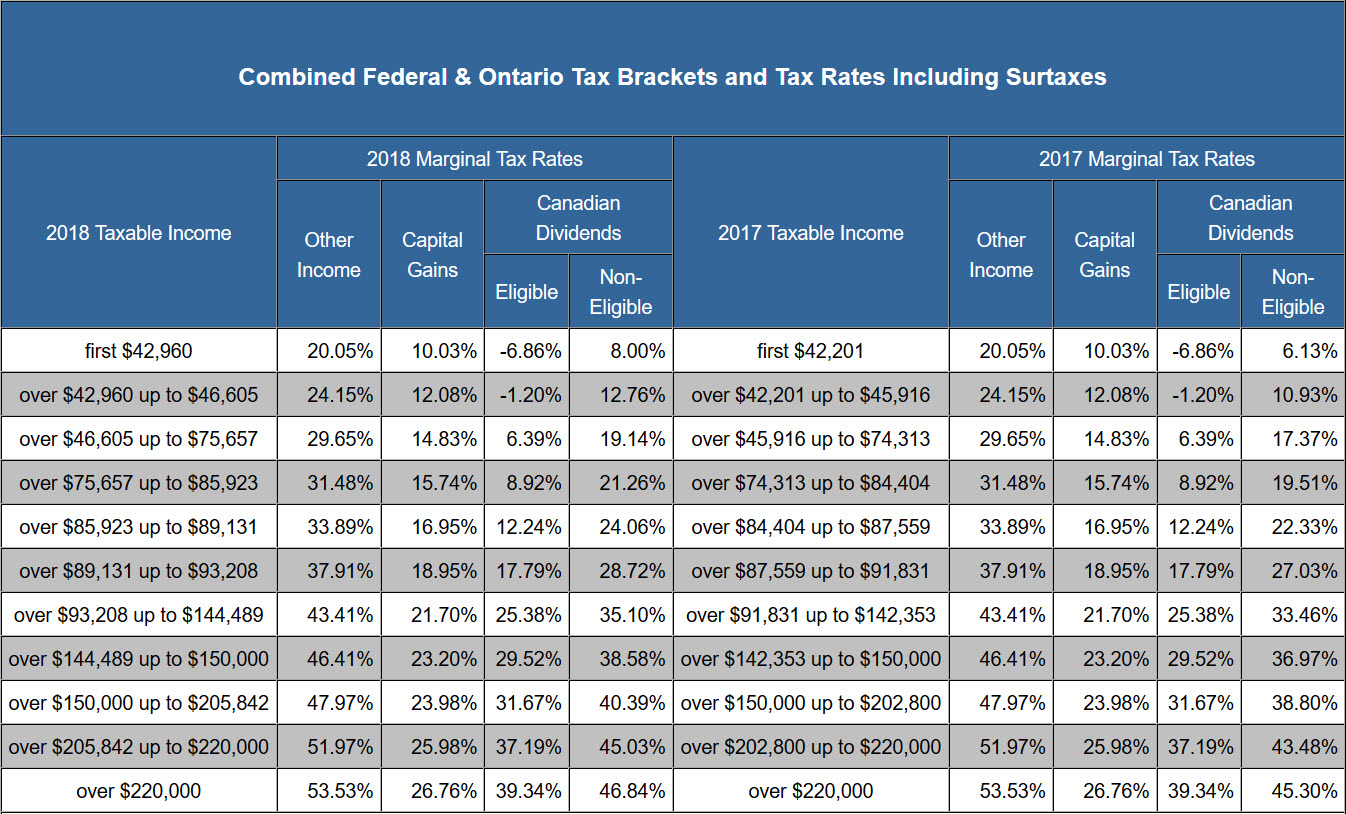

Ontario 2025 Tax Brackets Zia Lilyan All rates are subject to change pursuant to future legislative announcements. Ontario surtax of 20% applies to the provincial income tax (before surtax) in excess of $5,710.

Source: archerdowm.pages.dev

Source: archerdowm.pages.dev

2025 Tax Brackets Ontario Archer M. Dow Ontario surtax of 20% applies to the provincial income tax (before surtax) in excess of $5,710. The 2025 tax figures represent rates as of february 2025.

Source: lorenzochase.pages.dev

Source: lorenzochase.pages.dev

Tax Brackets 2025 In Canada Lorenzo Chase Ontario surtax of 36% applies in addition to the. Review ontario's 2025 federal and provincial personal income tax rates and determine your tax bracket and marginal tax rate.

Source: stacihjkchristie.pages.dev

Source: stacihjkchristie.pages.dev

2025 Tax Rates Ontario Aryn Libbie All rates are subject to change pursuant to future legislative announcements. It is changed based on changes in the.

Source: morganmoss.pages.dev

Source: morganmoss.pages.dev

2025 Tax Brackets Ontario Moss The 2025 tax figures represent rates as of february 2025. For 2025, the provincial income thresholds and personal amount have been indexed.

Source: ivylawsons.pages.dev

Source: ivylawsons.pages.dev

Canada 2025 And 2025 Tax Rates & Tax Brackets Images References Ivy It is changed based on changes in the. Review ontario's 2025 federal and provincial personal income tax rates and determine your tax bracket and marginal tax rate.

Source: linhjkgabriellia.pages.dev

Source: linhjkgabriellia.pages.dev

2025 Tax Brackets Ontario Canada Jonie Sephira Ontario surtax of 20% applies to the provincial income tax (before surtax) in excess of $5,710. The 2025 tax figures represent rates as of february 2025.

Source: mackenzieminifiea.pages.dev

Source: mackenzieminifiea.pages.dev

2025 Tax Brackets Canada Mackenzie A. Minifie The 2025 tax figures represent rates as of february 2025. Review ontario's 2025 federal and provincial personal income tax rates and determine your tax bracket and marginal tax rate.

Source: jorryaserhianon.pages.dev

Source: jorryaserhianon.pages.dev

What Are The Tax Brackets For 2025 In Canada Ontario Alanah Evangelina The 2025 tax figures represent rates as of february 2025. It is changed based on changes in the.

Source: ivylawsons.pages.dev

Source: ivylawsons.pages.dev

Source: masonsinclairb.pages.dev

Source: masonsinclairb.pages.dev Source: linhjkgabriellia.pages.dev

Source: linhjkgabriellia.pages.dev Source: karolvkerianne.pages.dev

Source: karolvkerianne.pages.dev Source: archerdowm.pages.dev

Source: archerdowm.pages.dev Source: lorenzochase.pages.dev

Source: lorenzochase.pages.dev Source: stacihjkchristie.pages.dev

Source: stacihjkchristie.pages.dev Source: morganmoss.pages.dev

Source: morganmoss.pages.dev Source: linhjkgabriellia.pages.dev

Source: linhjkgabriellia.pages.dev Source: mackenzieminifiea.pages.dev

Source: mackenzieminifiea.pages.dev Source: jorryaserhianon.pages.dev

Source: jorryaserhianon.pages.dev